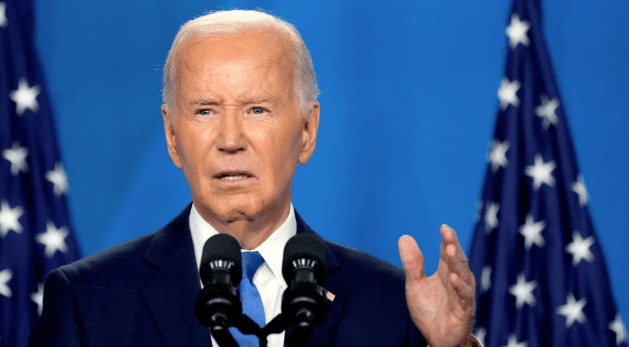

The unexpected turn of events that saw President Joe Biden stepping down from his re-election campaign and routing his support towards Vice President Kamala Harris has created a significant ripple in the financial markets forecast. The Democratic party has demonstrated a majority endorsement for Harris, but her nomination has not been solidified yet. Interestingly, Harris seems to have an edge over Biden when surveyed against Trump, but the reliability of these poll results can be questioned given the recent rapid transformations in the political arena.

Market watchers have diverging views on how Biden's decision is likely to impact the upcoming election and the financial markets. As Goldman Sachs specialists pointed out in a Monday note, the implied odds predicted by the market for a Democratic victory in the White House have slotted up, albeit the probability remains under 40%. The chances of a "Republican sweep" purportedly saw a slight dip following the Sunday news, but it is still perceived as the most probable outcome, as per these analysts.

There are speculations among certain market analysts about a potential collapse of the "Trump Trade," denoting investments made in stocks likely to gain from Trump retaining office in November and implementing his pledge to reduce government oversight and extend his 2017 tax cuts that are slated to lapse in 2025.

As per insights by Kinsale Trading analysts, the tightened race may likely trigger some undoing of the enthusiasm the "Republican sweep" had generated and fueled a surge in stocks in early-to-mid July.

Banking giants Deutsche Bank have proposed an alternative view that the market is more indifferent towards the candidate than assumed. They suggest an intensifying race adds to the uncertaintly causing obstacles for stocks. Conversely, if any party seems to be monopolizing the election, it reduces risk. The note they released on Friday reflected their interpretation that the recent two-day market plunge was partially attributed to a slight shift in the Presidential race due to speculations regarding Biden's withdrawal.

As it happened, major stock indexes experienced a major dip on Thursday and Friday, led by a technology stocks selloff. Subsequently, the broader market made some recovery on Monday, initiated by a rebound in tech stocks.